Investment Dynamics: Diversification and Correlation

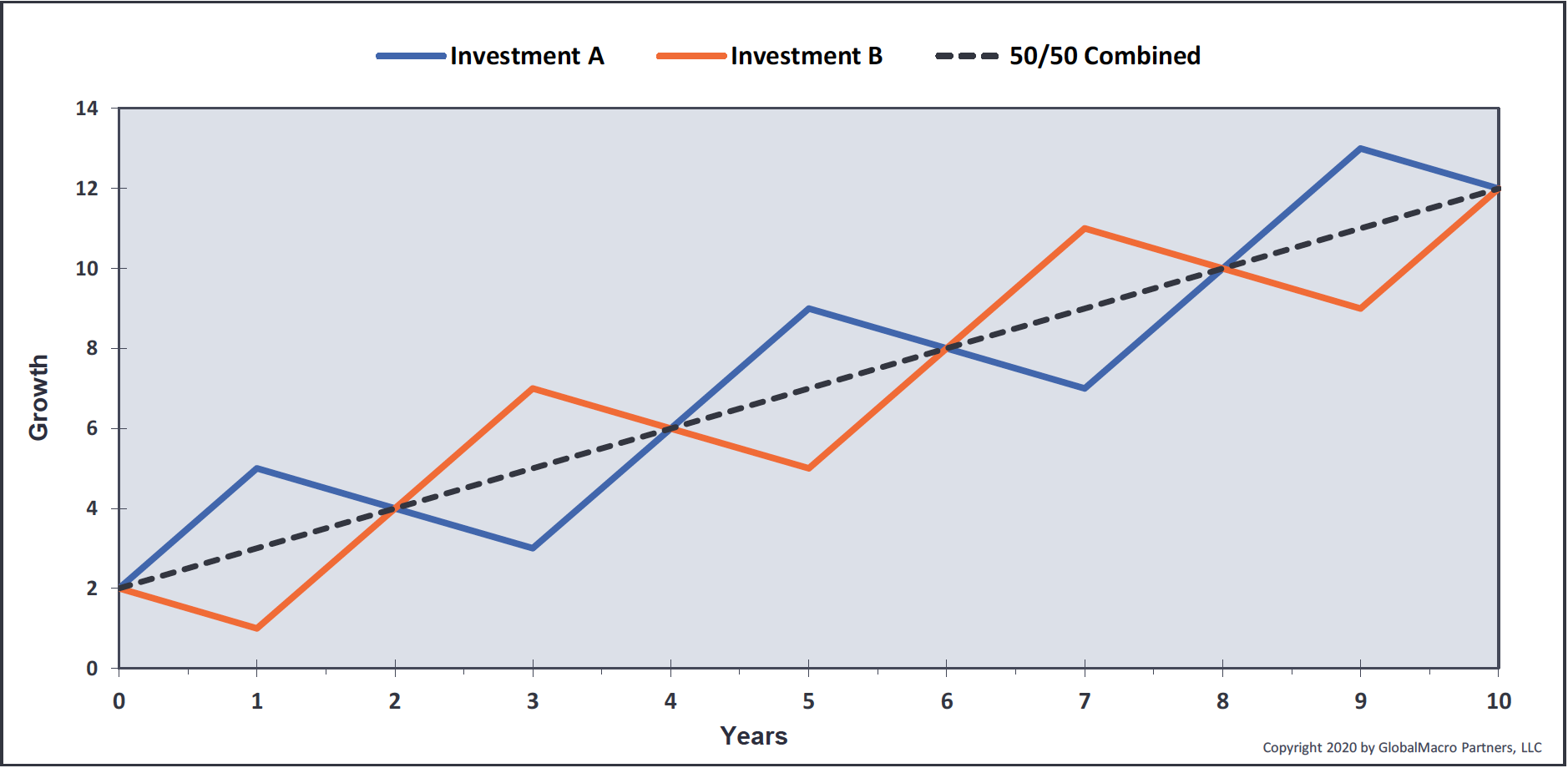

July 7, 2020An important key to enhancing portfolio performance and reducing risk is through more effective portfolio diversification. As the chart below shows, this can be achieved by combining asset classes that exhibit low correlations to one another.

Low Correlations to Other Asset Classes

Source: GlobalMacro Partners, LLC

Please note that the information shown above is for illustrative purposes only. Past performance is no guarantee future results.

Global Correlations Rising

Asset class correlations can be very tricky because they are always shifting.

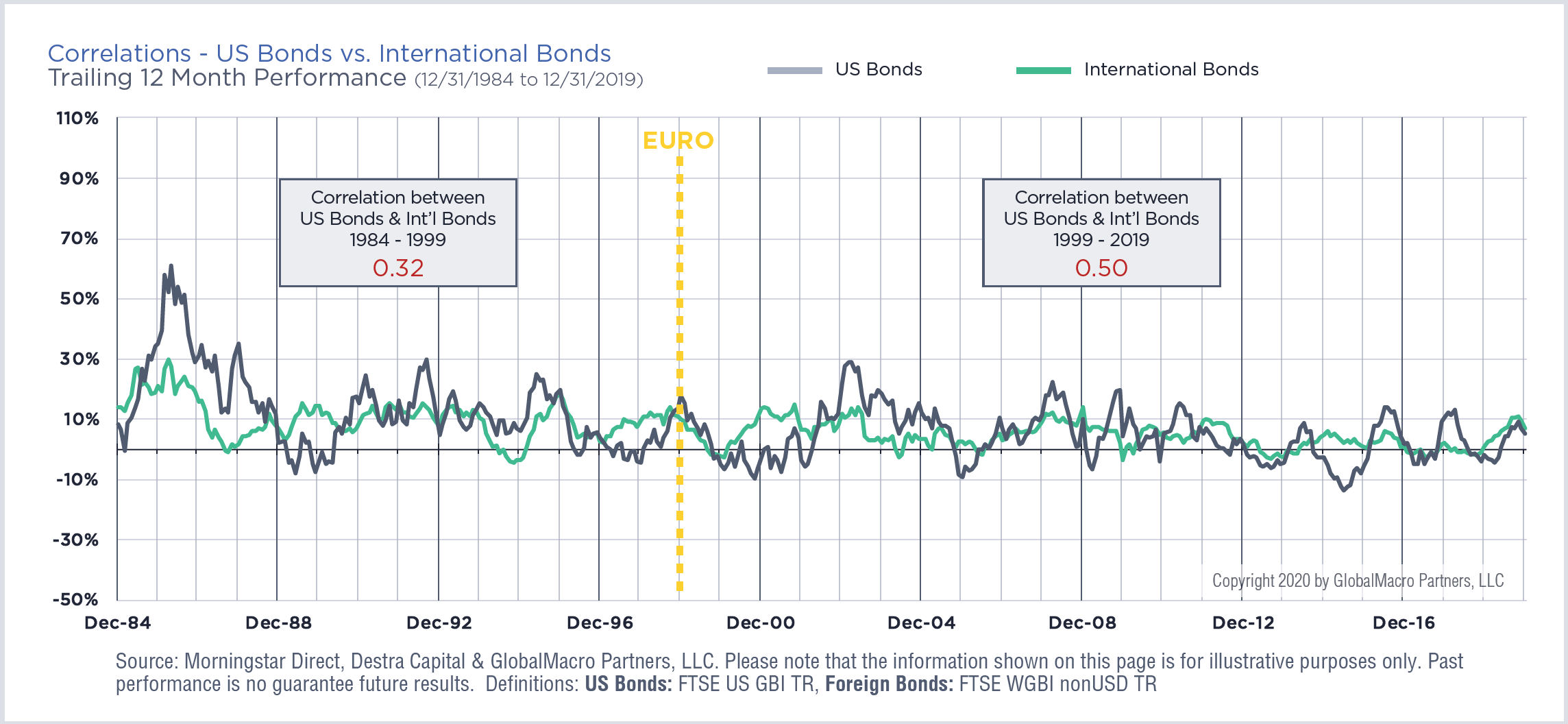

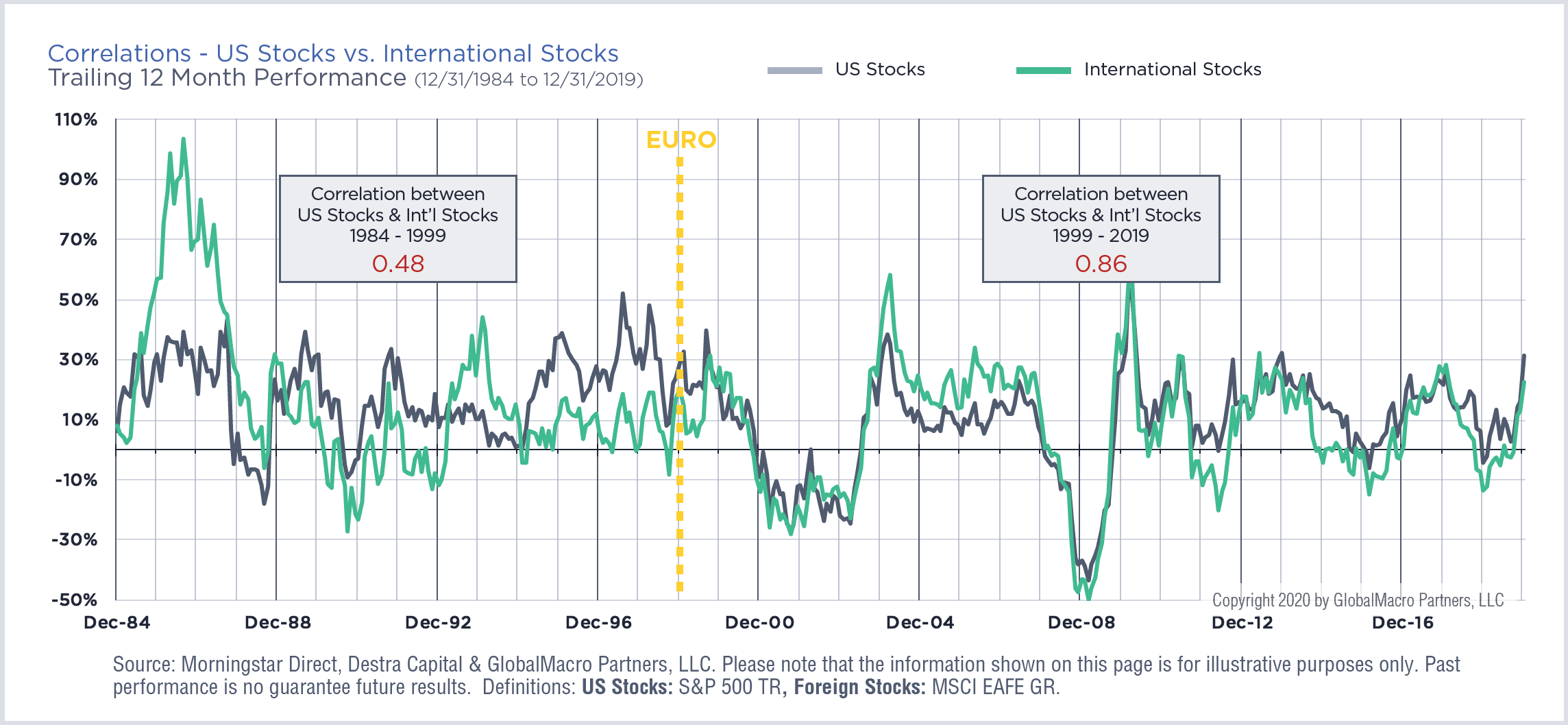

Many investors don’t realize that since the implementation of the EURO in 1999, the diversification benefits of many asset classes have been reduced or even eliminated. The search for non-correlated asset classes requires careful analysis and constant review.

| Asset Classes | Correlations vs. Foreign Bonds 1999-2019 |

|---|---|

| US Bonds | 0.50 |

| US High Yield Bonds | 0.19 |

| US Stocks | 0.11 |

| Foreign Stocks | 0.33 |

| REITs | 0.25 |

| Commodities | 0.20 |

| Hedge Funds | 0.18 |

Source: Morningstar Direct, Destra Capital and GlobalMacro Partners, LLC. Please note that the information shown is for illustrative purposes only. Past performance is no guarantee future results. Definitions: US Bonds: FTSE US GBI TR; Foreign Stocks: MSCI EAFE GR; US REITs: FTSE NAREIT All Equity TR; Commodities: S&P GSCI TR; US High Yield Bonds: Barclays US Corporate High Yield Bond TR; Hedge Funds: Credit Suisse Hedge Fund Index; Foreign Bonds: FTSE WGBI nonUSD TR; US Stocks = S&P 500 TR

Best Diversifier: International Stocks or International Bonds?

Since the introduction of the Euro in 1999, the correlations between US stocks and international stocks nearly doubled from 0.48 to 0.86. As you can see on the following chart, US and international stocks have become highly correlated and move in near unison, providing very little diversification benefit against geopolitical risk, economic scares, and the risk-on, risk-off trade.

In contrast to stocks, US bonds and international bonds continue to maintain low correlations, before and after 1999; providing important diversification benefits to a US-centric portfolio.