you are leaving Destracapital.com

It is important to note that by clicking on this link you will be leaving this website and any information viewed there is not the property of Destra Capital Investments LLC.

Destra Multi-Alternative Fund (NYSE: DMA)

Sub-Advised by Validex Global Investing

MARKET PRICE DISTRIBUTION RATE1

15.03%

As of 1/29/26

Premium/(Discount)

(9.20%)

as of 1/29/26

Market Price

$8.98

as of 1/29/26

Net Asset Value

$9.89

As of 1/29/26

1 Monthly distribution per share annualized and divided by the January 29, 2026 market price per share. The distribution rate alone is not indicative of Fund performance.

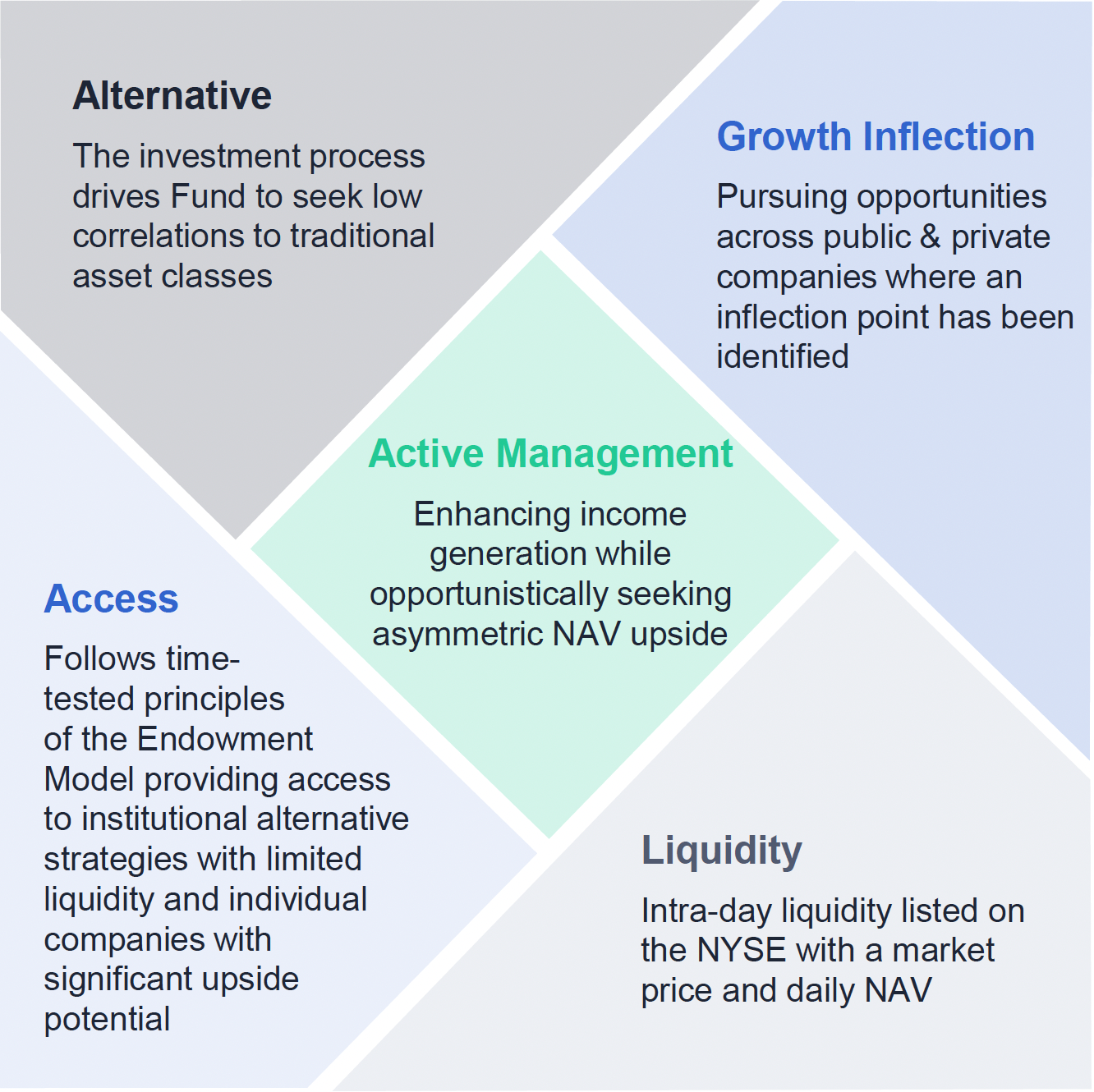

The Destra Multi-Alternative Fund (the “Fund”) is an exchange-listed closed-end fund that seeks to achieve long-term performance non-correlated to the broad stock and bond markets. It invests primarily in alternative strategies and asset classes including real estate, direct private equity, alternative credit, and hedge strategies.

The Fund gives investors access to institutional alternative strategies that may provide more opportunity for total return from different sources than traditional investments, without the high minimum investments or lock ups that such strategies often require.

The Fund aims to maximize risk-adjusted returns and therefore does not try to directly compete with stocks or bonds. Instead, it consists of investments with historically low correlations to these traditional asset classes, seeking to lower overall volatility and add value to an investor’s existing investment portfolio across a variety of market cycles.

Alternative investments typically have a different return profile and different risks than traditional investments. There is no guarantee that the Fund will achieve its objectives, generate profits, or avoid losses.

The Alternative Closed-End Fund

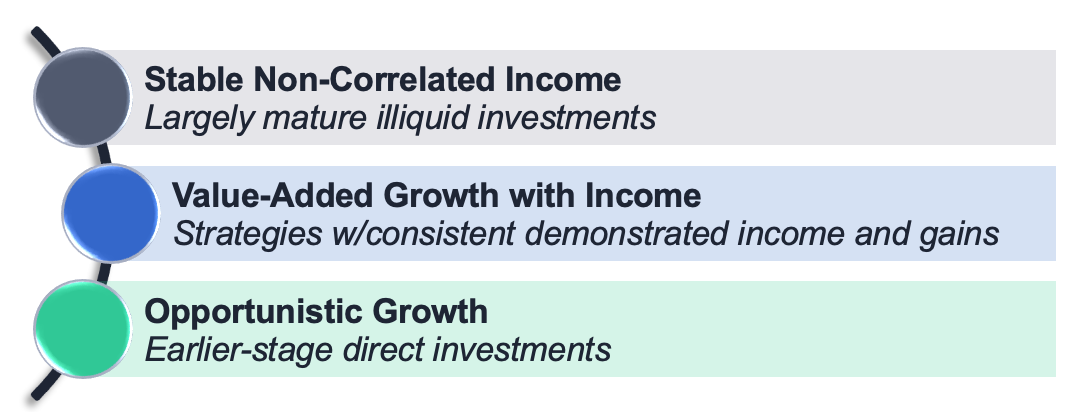

The Fund seeks returns from capital appreciation and income with an emphasis on income generation. The closed-end fund structure allows the Fund to invest a substantial amount of its capital in institutional-quality, longer-horizon individual investments and strategies. Some of these strategies and assets may be less liquid, providing an opportunity to capture illiquidity premiums embedded in these instruments as they mature, for the benefit of the Fund’s shareholders.

As with most alternative investment strategies, a major objective of the Fund is to reduce volatility relative to traditional asset classes. This combination of alternative sources of return and risk and a goal of low correlation to traditional stocks and bonds may make the Fund a core alternative solution or component of a well-diversified portfolio.

Potential Benefits

Investment Strategy

Allocating to Alternatives

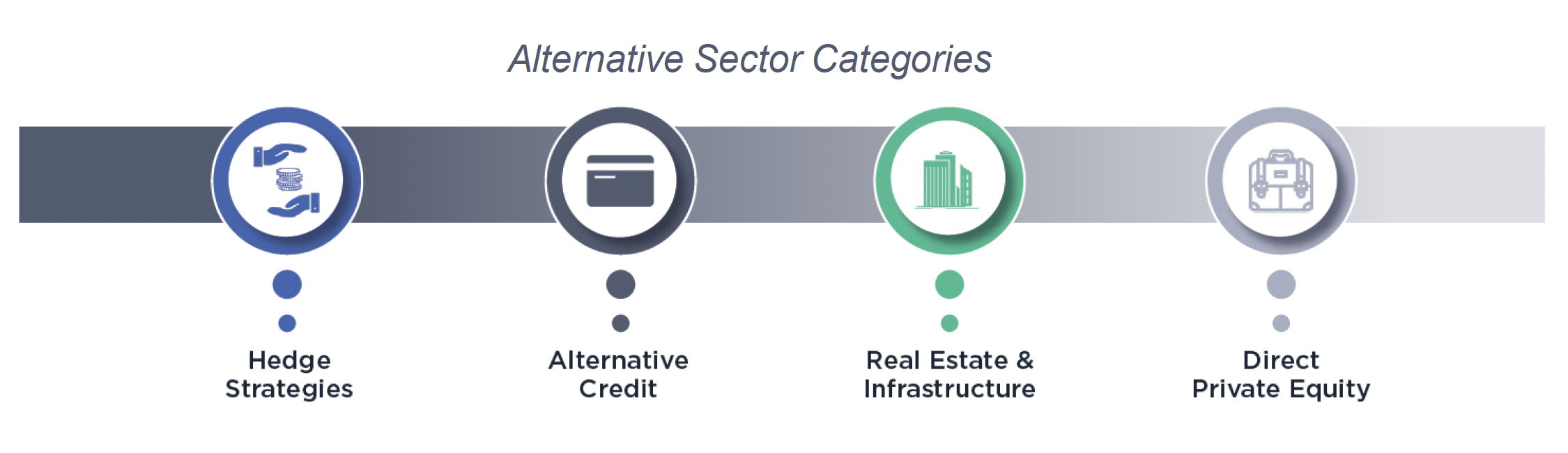

The Fund may invest across multiple alternative categories and strategies, including:

Institutional Endowment Approach Executed Within an Easy-to-Access Fund

The Destra Multi-Alternative Fund invests following a time-tested strategy used by many endowments and foundations. This process, sometimes called the “Endowment Model,” exploits the opportunities of long time horizons that endowments, foundations and closed-end funds can pursue because of their unique structures. This changes the nature of investments that may be considered, and the ability to commit capital to certain assets and strategies through a full investment cycle.

Total Return Focused, Low Correlation Potential.

There is no guarantee that any investment strategy will achieve its objectives, generate profits, or avoid losses.

Unique Total Return Model

- Broadens CEF Exposure – Traditional CEFs have a heavy emphasis on monthly or quarterly income generation exclusively

- DMA actively pursues non-correlated sources of NAV growth and income across a range of opportunity sets

Performance

Average Annual Total Returns as of 12/31/25

| Share Class | Ticker | 3 MO | 6 MO | 1YR | 3YR | 5YR | 10YR | from incep.* |

|---|---|---|---|---|---|---|---|---|

| Market Price | DMA | 7.36 | 9.06 | 16.83 | 16.54 | n/a** | n/a** | n/a** |

| NAV | XDMAX | 0.95 | 2.61 | -1.90 | 1.89 | 1.38 | 1.26 | 2.54 |

Source: Morningstar

Data presented reflects past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 877.855.3434 or access our website at destracapital.com for performance current to the most recent month end. Returns for period of less than one year are not annualized, and include reinvestment of all distributions. The Fund’s Gross/Net Expense ratios are 2.50%/2.12%.

Effective January 13, 2022, the Investment Manager and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Investment Manager has agreed to reimburse and/or pay or absorb, on a quarterly basis, the “ordinary operating expenses” (as defined below) of the Fund to the extent that such expenses exceed 0.53% per annum of the Fund’s average daily net assets (the “Expense Limitation”). For the purposes of the Expense Limitation Agreement, “ordinary operating expenses” consist of all ordinary expenses of the Fund, including administration fees, transfer agent fees, organization and offering expenses, fees paid to the Fund’s trustees, administrative services expenses, and related costs associated with legal, regulatory compliance and investor relations, but excluding the following: (a) investment management fees, (b) portfolio transaction and other investment-related costs (including brokerage commissions, dealer and underwriter spreads, and commitment fees on any leverage facilities, prime broker fees and expenses, and dividend expenses related to short sales), (c) interest expense and other financing costs, (d) taxes, (e) distribution fees and/or shareholder servicing fees, if any, (f) acquired fund fees and expenses and (g) extraordinary expenses. Any waiver or reimbursement by the Investment Manager under the Expense Limitation Agreement is subject to repayment by the Fund within three years from the date the Investment Manager waived any payment or reimbursed any expense, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver or the current expense limitation and the repayment is approved by the Board. Unless terminated by the Board, the Expense Limitation Agreement will continue in effect until at least January 13, 2027. The Board may terminate this Expense Limitation Agreement upon sixty (60) days’ written notice to the Investment Manager.

*The Fund’s Since Inception return is based on the Fund’s class A Share inception date on 3/16/2012. The class A Share returns, net of A share expenses, were used from 3/16/2012 inception until the class I share inception date on 7/2/2014. From 7/2/2014, the class I share returns net of I share expenses were used thereafter until the Fund listing date and conversion into common listed share class on 1/13/2022. No synthetic expenses have been retroactively applied to the combined historical performance.

** The Fund listed on the NYSE on 1/13/22.

Investors cannot invest directly in an index and index returns do not reflect any fees, expenses or sales charges directly in an index.

Risk & Return Statistics as of 9/30/25

| Total Return (%) | Standard Deviation | Sharpe Ratio | Sortino Ratio | |

|---|---|---|---|---|

| Fund1 | 2.52 | 7.26 | 0.21 | 0.22 |

| Index2 | 2.23 | 5.12 | 0.19 | 0.21 |

| Peers3 | 3.12 | 4.76 | 0.46 | 0.49 |

Comparison Metrics (3/17/12 to 9/30/25)

| Alpha | Beta | Excess Return (%) | R2 (%) | Up Capture (%) | Down Capture (%) | |

|---|---|---|---|---|---|---|

| Index2 | 0.53 | 0.75 | 0.28 | 28.58 | 76.68 | 72.90 |

| Peers3 | -0.31 | 0.89 | -0.60 | 34.25 | 80.08 | 79.98 |

Investors buy and sell shares at the MKT rate now that the Fund is listed. The risk metrics and performance stats shown here are at NAV since inception of the Fund and reflect the performance of the underlying portfolio. MKT price can and usually does deviate from NAV, sometimes significantly.

Correlations to Other Asset Classes

| Fund1 | Index2 | Peers3 | Cash4 | Bonds5 | Stocks6 | |

|---|---|---|---|---|---|---|

| Fund1 | 1.00 | |||||

| Index2 | 0.53 | 1.00 | ||||

| Peers3 | 0.58 | 0.87 | 1.00 | |||

| Cash4 | -0.04 | -0.03 | -0.04 | 1.00 | ||

| Bonds5 | 0.08 | 0.05 | -0.02 | 0.18 | 1.00 | |

| Stocks6 | 0.57 | 0.82 | 0.87 | -0.03 | -0.05 | 1.00 |

Glossary: Fund1: Destra Multi-Alternative Fund (XDMAX) Index2: Wilshire Liquid Alt Multi-Strategy TR Peers3: Morningstar US Fund MultiAlternative Category Cash4: Bloomberg US Treasury Bills TR USD Index Bonds5: Bloomberg Barclays US Aggregate Bond TR USD Index Stocks6: S&P 500 TR USD Index Alternatives

Fund Basics

1 The closing price at which the Fund’s shares were traded on the exchange. 2 Per-share dollar value of the Fund, calculated by dividing the total value of all the securities in its portfolio, plus any other assets and less liabilities, by the number of Fund shares outstanding. |

Portfolio Characteristicsas of 9/30/25

|

|||||||||||||||||||||||||||||||||

Asset Allocationas of 9/30/25 |

|

|||||||||||||||||||||||||||||||||

Alternative Sector Breakdownas of 9/30/25 |

|

|||||||||||||||||||||||||||||||||

Top 10 Holdings (% of total assets)as of 9/30/25

Holdings are subject to change without notice. There is no assurance that the investment process will lead to successful investing. All compositions are subject to daily changes with market actions. DMA Exchange Listed Trading Group

The DMA Exchange Listed Trading Group represents closed-end funds that have been chosen to reflect alternative, non-traditional, and specialty investment strategies, that in aggregate may provide a reference for performance and trading of the Destra Multi-Alternative Fund. *AIF has been removed from the initial peer group due to pending merger announcement into BDC structure. |

Literature & Communications

Marketing Materials

Regulatory Documents

Press Releases

Webcasts

Distributions

Portfolio Managers

Validex Global InvestingValidex Global Investing seeks growth at the edge of inflection. Their proprietary research aims to identify emergent turning points as they unfold, pairing high-conviction opportunities with sophisticated risk-mitigation strategies across both private and public markets. Investment TeamMark Scalzo Zach Leeds |

|

Glossary

Gross Expense Ratio: Expense ratio is a measure of what it costs to operate an investment, expressed here as a percentage of its assets. These are costs the investor pays through a reduction in the investment’s rate of return. The gross expense ratio is the total annual fund or class operating expenses directly paid by the fund from the fund’s most recent prospectus (before waivers or reimbursements). This ratio also includes Acquired Fund Fees & Expenses, which are expenses indirectly incurred by a fund through its ownership of shares in other investment companies. Net Expense Ratio: Expense ratio is a measure of what it costs to operate an investment, expressed here as a percentage of its assets. These are costs the investor pays through a reduction in the investment’s rate of return. The net expense ratio is the total annual fund or class operating expenses directly paid by the fund from the fund’s most recent prospectus, after any fee waiver &/or expense reimbursements that will reduce any fund operating expenses. This ratio also includes Acquired Fund Fees & Expenses, which are expenses indirectly incurred by a fund through its ownership of shares in other investment companies. This number does not include any fee waiver arrangement or expense reimbursement that may be terminated without agreement of the fund’s board of trustees during the one-year period.

Alpha: A measure of performance on a risk-adjusted basis. Alpha compares the volatility (price risk) of the Fund to risk-adjusted performance of the benchmark Index. The excess return of the Fund relative to the return of the Index is the Fund’s alpha.

Beta: A measure of a fund’s sensitivity to market movements - market movements are represented by a benchmark index. A benchmark index has a beta of 1.0. A beta greater than 1.0 indicates that a fund’s historical returns have fluctuated more than the benchmark index. A beta less than 1.0 indicates that a fund’s historical returns have fluctuated less than the benchmark index. Correlation: a statistic that measures the degree to which two securities move in relation to each other.

Excess Return: Excess returns are returns achieved above and beyond the return of a proxy.

Market Capture Ratios: A statistical measure of the Fund’s overall performance in up-markets (positive return periods) and down markets (negative return periods). The ratio is calculated by dividing the Fund’s returns by the returns of the index during the up-market or the down-market, and multiplying that factor by 100.

R2: R-squared measures the relationship between a fund and a benchmark. A higher R2 (closer to 100%) indicates that the portfolio moves like the benchmark.

Sharpe Ratio: A measure of historical risk-adjusted performance calculated by dividing the fund’s excess returns over a risk-free rate by the standard deviation of those returns. The higher the ratio, the better the fund’s return per unit of risk.

Sortino Ratio: The Sortino ratio is a variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset’s standard deviation of negative portfolio returns deviation, instead of the total standard deviation of portfolio returns.

Standard Deviation: An annualized statistical measure of how much a fund’s returns have varied over a period of time. The more variable the returns, the higher the standard deviation. A higher standard deviation also indicates a wider dispersion of past returns and thus greater historical volatility.

Bloomberg Barclays US Aggregate Bond Index - measures the performance of the U.S. investment grade bond market.

IA SBBI US 30 Day T-Bills Index - measures the performance of one-month maturity US Treasury Bills.

Morningstar Broad Hedge Fund Index – rules-based, asset-weighted index designed to capture the performance of the most investable hedge funds.

Morningstar Diversified Alts Index - provides diversified exposure to alternative asset classes in the ProShares ETF lineup.

Morningstar US Fund MultiStrategy Category - Multistrategy funds allocate capital to a mix of alternative strategies (at least 30% combined), as defined by Morningstar’s alternative category classifications.

S&P 500 Index – measures the performance pf the largest 500 U.S. common stocks chosen to reflect the industries in the U.S. economy.

Risks

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. Please see below risk for underlying holdings of the Fund. Future distribution rate amounts, if any. are expected to be paid annually from ordinary income received and net capital gains realized from the disposition of Fund investments. Distribution amount is not indicative of Fund performance. Current distributions and target yields are not guaranteed and may not be met in the future. Shareholders receiving periodic payments from the Fund may be under the impression that they are receiving net profits. However, all or a portion of a distribution may consist of a return of capital. A portion of the Fund’s distributions consisting of a return of capital are often based on the character of the distributions received from the underlying holdings, primarily real estate investment trusts. Investing involves risk including the possible loss of principal. Alternative investment funds, ETFs, mutual funds, and closed-end funds are subject to management and other expenses, which will be indirectly paid by the Fund. Issuers of debt securities may not make scheduled interest and principal payments, resulting in losses to the Fund. Typically, a rise in interest rates causes a decline in the value of fixed-income securities. Lower-quality debt securities, known as “high-yield” or “junk” bonds, present greater risk than bonds of higher quality, including increased default risk and non-diversification risk as the funds are more vulnerable to events affecting a single issuer. The use of leverage, such as borrowing money to purchase securities, will cause the Fund to incur additional expenses and will magnify the Fund’s gains or losses. Investments in lesser-known, small- and medium-capitalization companies may be more vulnerable than those in larger, more established organizations. The Fund will not invest in real estate directly, but, because the Fund will concentrate its investments in securities of REITs, its portfolio will be significantly impacted by the performance of the real estate market. The value of a structured note will be influenced by time to maturity; type of note; market volatility; changes in the issuer’s credit quality rating; and economic, legal, political, or geographic events that affect the reference index.

Validex Global Investing is the Fund’s sub-advisor. Destra Capital Advisors LLC, a registered investment advisor, is the Fund’s investment manager and is providing secondary market servicing for the Fund.